How is ESG shaping the RemCo strategy? We hosted an engaging and well-attended webinar on the subject.

We were joined by an expert panel comprising:

- Tea Colaianni: Chair of RemCo at Watches of Switzerland Group Plc and DWF Group Plc

- Boris Huard: NED and RemCo chair, Dotdigital PLC

- Louis Cooper: CEO of the Non-Executive Directors’ Association

You can listen to the full webinar recording here.

Remuneration policies should support strategy and the long-term success of an organisation. They should focus on six main areas:

- Clarity

- Simplicity

- An understanding of reputational and behavioural risk

- Predictability in the explanation of the range of rewards

- Proportionality in terms of relevance to the organisation’s position

- Alignment to corporate, risk, board and pay culture

At Eton Bridge Partners, we have seen in recent board-level hires a rise in the importance of the Environmental, Social and Governance considerations – now more commonly referred to as ‘ESG’. The understanding of an organisation’s ESG strategy, and its implementation, is a key part of the interview process.

Two years ago, it was relatively uncommon for ESG to be a key thread – now it is unusual not to discuss it.

It is essential that a board demonstrates leadership and sets the right tone on the issue. Louis said: “We need a call to action to make sure we have a prioritised plan that can be followed through – that really needs to be driven from the board, with support from the remuneration committee.”

With ESG now a key strategic element on the radar, it is also important that a board considers what is happening in the day-to-day running of an organisation and how its culture, and the behaviours of the people within it, are managed appropriately from the perspective of implementing a Remuneration Committee (‘RemCo’) strategy that incorporates ESG considerations.

Click here to watch the full discussion.

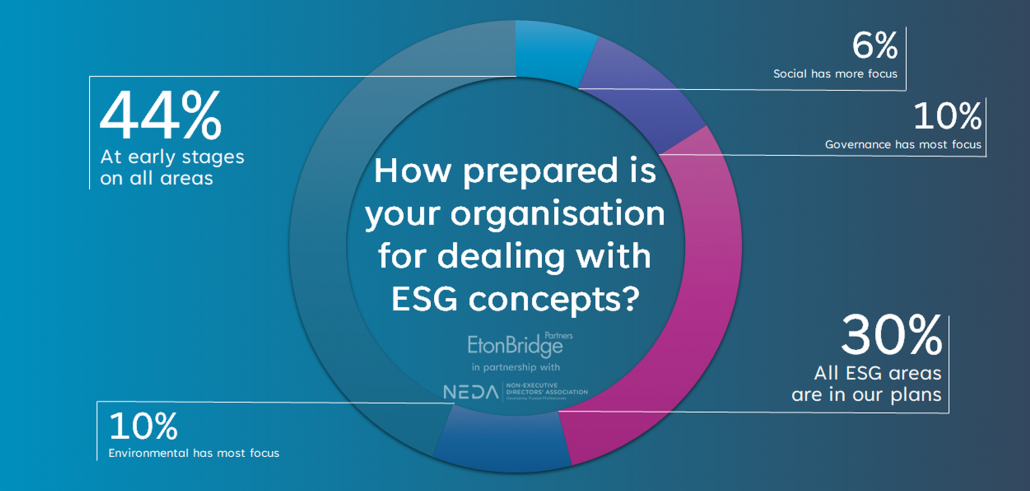

Attendees were invited to share the extent to which ESG policies had been embraced by their organisations, and to which they are influencing the RemCo discussion.

How prepared is your organisation in dealing with ESG concepts?

Tea reported that one business with which she is involved is “incredibly advanced”. It has a comprehensive strategy on climate action, diversity and inclusion, empowering colleagues and communities, and building trust. She said: “This organisation sees ESG as giving it a commercial advantage, as well as being the ethical thing to do.”

ESG should be mainstream to the RemCo discussion, Boris has seen. “In purpose-led organisations, that opportunity goes beyond the remuneration discussion and should be on the main board agenda.”

The social impact of an organisation matters in talent attraction and retention – people increasingly care about the outcome of their work.

Is it most appropriate to talk about ESG at the board, the risk committee or the audit committee? Tea noted from her experience that: “This should be a responsibility at main board level. We need to make sure there is always an update on what we are doing and the strategy, plan and execution.”

How prepared is your organisation with all of the Environmental and Sustainability reporting and disclosure requirements?

Boris believes that: “ESG is a very good proxy for operational excellence. We try to do the right things, bring that to the DNA of the organisation and make it part of the service we provide to our customers.”

One barrier to a consistent understanding about organisations’ progress in reporting is that there have been various organisations involved.

Louis pointed out: “The TCFD [Task Force on Climate-Related Financial Disclosures] seems to be getting most of the momentum in terms of reporting requirements. Consistency is a key theme in terms of the common metrics that can create good comparisons and an understanding of how different organisations are coping.”

Has your Remuneration Committee started looking at ESG matters as part of its work programme and remuneration policy development?

There can be challenges associated with moving from a unilateral focus on profits to a more complex, inclusive and balanced perspective. Tea observed that: “In some businesses, we have announced KPIs in terms of climate, gender and ethnicity, and we have included those objectives in the performance requirements of executive directors.”

The remuneration discussion used to be around very objective criteria; but most of the value of an organisation can be intangible.

Boris concluded that:

Many policies within an HR department play towards having the right social inclusion. Those will never be strictly connected to the remuneration – but they are an integral part of achieving the outcome. It is a work in progress making that explicit and fully disclosable.

Download a digital copy of the discussion here.

Thank you to all who attended this webinar for sharing their insights and, as ever, posing excellent questions to our panel.

03.02.22

Related content

Keep in touch

We’d love to stay in touch, please register to receive topical insights and exclusive event invitations.

Subscribe to our mailing list